FAQ

- Financing amounts between 3 and 15 million euros

- Financing matures in 3 to 7 years

- A minimum investment of 55% will be made in France, with a maximum of 45% outside France, in the European Union and Switzerland.

- Collateral essential to the company's activities At least 50% of loans will be secured by inventory, and no more than 50% by equipment.

A pledge with delivery is a contract that enables a company to use its inventory as collateral for financing. The solidity of the system makes it possible to provide companies with a significant amount of financing.

Here are the key points to bear in mind:

- The notion of dispossession does not imply transfer of ownership: the company retains ownership of the inventory, but transfers possession of the asset to the creditor until the debt is repaid. Dispossession takes the form of the intervention of a trusted third party called a third-party holder, whose main role is the practical implementation of the pledge.

- Inputs and outputs function normally. In return, a minimum stock level must be maintained. In the event of default, the creditor may exercise a right of retention.

- The company communicates a daily inventory to the third party holder, who will regularly check the physical presence of the stock.

Asset-owning SMEs and SMBs can leverage their inventories and/or industrial equipment.

Thanks to Gagéo's offer, companies can strengthen their medium- and long-term financial structure by using financing backed by their inventories and/or essential equipment.

To qualify, companies must have annual sales of at least €10 million, or €20 million for a group of companies, and inventories of over €6 million.

Depending on the case, their needs may arise from the following situations:

- growing companies at the limit of their banking facilities, wishing to strengthen their financial structure with medium- and long-term financing,

- companies wishing to diversify their sources of financing with long-term resources, without affecting their capital structure and without any dilutive effect,

- companies lacking adequate banking facilities and wishing to find financing to pursue their repositioning,

- companies under LBO wishing to refinance their mezzanine debt at a more attractive rate and alleviate restrictive covenants.

- companies looking to finance their operating cycle (WCR) and/or modernization/growth projects.

Stable, fully-owned inventories are a sustainable financing base for companies

Company inventories are pledged as collateral for financing. Depending on the case, the inventories pledged may be finished goods, raw materials or work-in-progress linked to long maturation cycles, such as wines and spirits.

They must be slow-maturing, not subject to retention-of-title clauses, and can be easily assessed & inspected during on-site visits.

Examples of eligible types of inventory include :

- raw materials used by companies in the industrial, agricultural and energy sectors,

- mechanical parts for the naval, automotive and aeronautical industries,

- wood, paper, packaging, furniture and manufacturing industry products,

- food products, wines and spirits,

- metal products and by-products,

- consumer durables,

- finished products from the shipbuilding, automotive, aeronautical,

- manufacturing and metallurgical industries.

Fonds Gagéo finances essential equipment for industrial operators.

Equipment eligible as collateral for Gagéo financing must have the following characteristics:

- be new or used industrial equipment or machine tools,

- be essential to the production process, activity and/or operation of the lessee,

- have a low obsolescence rate,

- be recoverable by third-party experts

- be capable of being remarketed.

Some examples of eligible types of equipment:

- fleets of industrial vehicles, lifting equipment or logging trucks,

- equipment leased to users, engines, handling equipment, etc.

- Industrial machine tools equipment for a paper production plant, such as press lines, die-cutting, packaging units, mold-making equipment, recycling lines, etc.

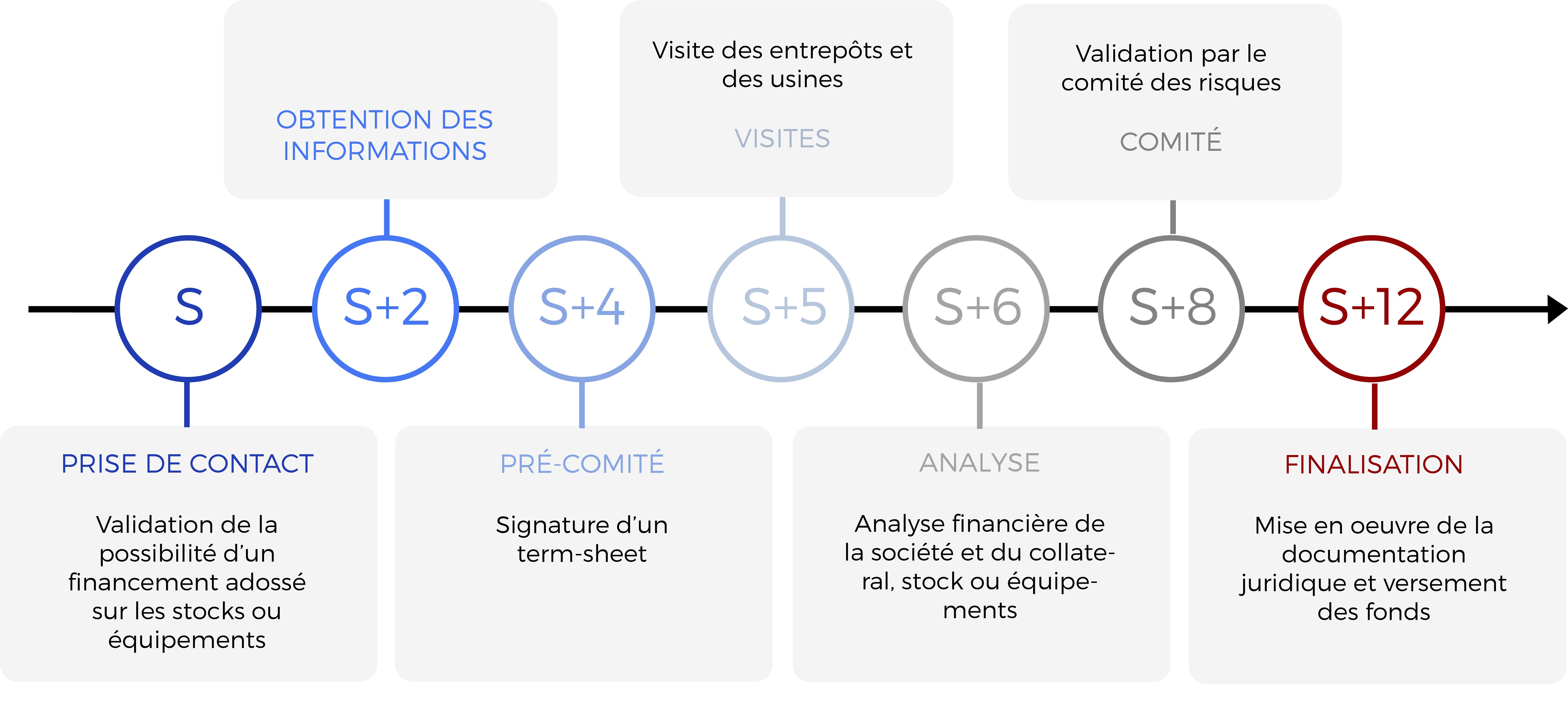

Afin d’instruire une demande de financement, chaque entreprise doit être en mesure de fournir un dossier d’information complet, portant à la fois sur ses performances financières passées et futures ainsi que ses actifs. Le tout permettant d’envisager une mise à disposition des fonds sous 12 semaines environ.